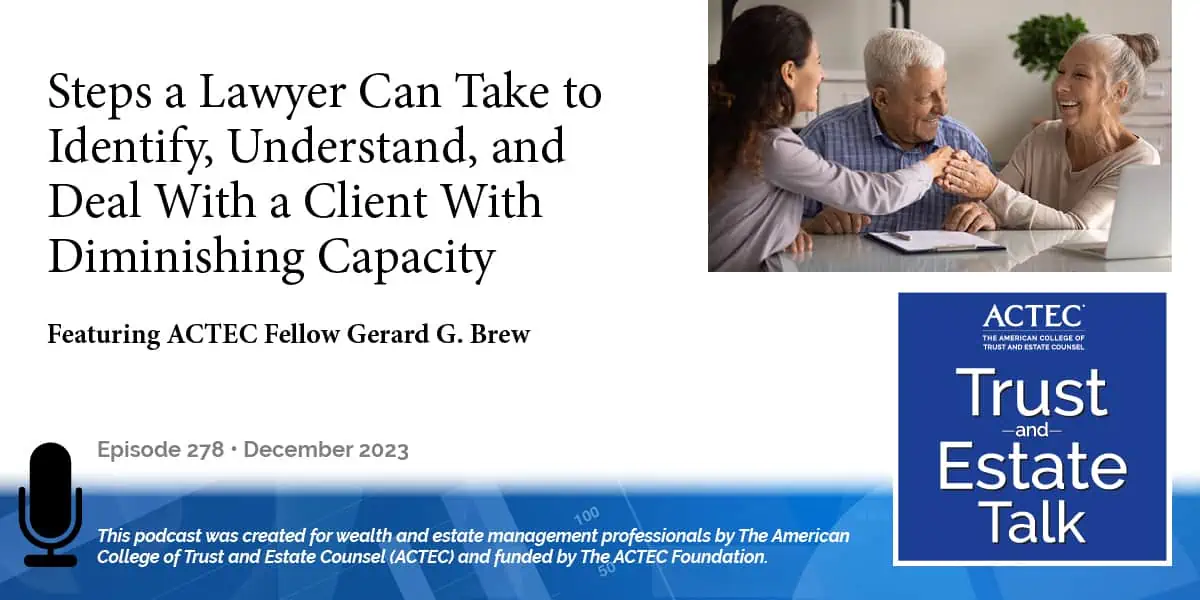

Exploring legal responsibilities in identifying and managing client diminishing capacity, from cognitive decline to ethical considerations in legal practice.

ACTEC Fellows share their expertise with professionals on trust administration and ongoing estate management. Discover more about best business practices, effective communication with trustees and beneficiaries, and how life changes such as retirement or divorce can impact these areas.

Exploring legal responsibilities in identifying and managing client diminishing capacity, from cognitive decline to ethical considerations in legal practice.

A presentation of how changing demographics and multiple generations impact the current world of estate planning and trust management.

Estate planning and trust management across multigeneration families. How do lower marriage rate and non-traditional families effect financial planning, estate planning, financial services?

What is probate lending and why you should consider including a spendthrift clause in a will is discussed by ACTEC Fellow Professor David Horton.

The valuation of cryptocurrency, IRS guidance on tax planning, and how to prepare for an appraisal are discussed by John Varga of MPI Business Valuation and Advisory.

A discussion of tax considerations when forming a business. Learn more about S corp, C corp, LLC, LLP, and tax reform in this podcast.

The rights of children to receive property from intestate estates and how to pass property effectively to children is discussed by Judge Butts and ACTEC Fellow Jane Ditelberg.